Author: Cara Tengco

By Euney Marie Mata-Perez on September 23, 2021

Clarity of tax rules and regulations is key to an efficient tax system. One of the areas that tax authorities have to clarify is the zero-rating of sales to enterprises operating in and registered under existing economic zones.

The Corporate Recovery...

BIR’S POWER TO OBTAIN INFORMATION

By Aziza Hannah Bacay on September 16, 2021

The Bureau of Internal Revenue (BIR) has the power to ascertain the correctness of the returns filed by the taxpayers and to determine any liability for internal revenue tax. Corollary to such power, the BIR is empowered and has the authority to obtain...

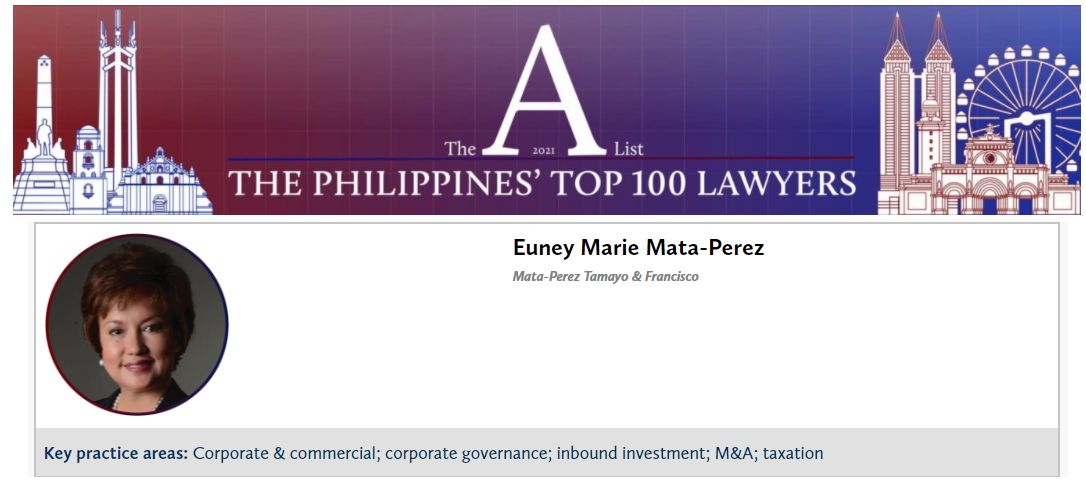

The Philippines’ Top 100 A-List lawyers of 2021

We are proud to announce that our very own Managing Partner, Atty. Euney Marie J. Mata-Perez, has once again been named one of The Philippines’ Top 100 A-List lawyers of 2021 by the Asia Business Law Journal!

The Philippines’ Top 100 A-List lawyers of 2021 is based on extensive research conducted...

THE TAX PRICE OF BEING AN INFLUENCER

By Euney Marie Mata-Perez on September 9, 2021

RECENTLY, the Bureau of Internal Revenue (BIR) issued Revenue Memorandum Circular (RMC) 97-2021, reminding social influencers about their tax obligations. It reminded them to register as taxpayers and report their income properly, as well as provided...

MTF MANAGING PARTNER SHARES HER TAX KNOWLEDGE IN VARIOUS WEBINARS

MTF Managing and founding partner, Atty. Euney Marie J. Mata-Perez, recently imparted her extensive knowledge in tax laws and jurisprudence in various webinars this August 2021, namely: “The Inaugural CREATE (Online) Summit” and the “Aboitiz Group: Tax Updates Lecture”.

The “Inaugural CREATE...

DISPENSING WITH THE BOND REQUIREMENT

By Aziza Hannah Bacay on September 2, 2021

As part of its collection efforts, the Bureau of Internal Revenue (BIR) can use summary administrative remedies such as warrants of distraint and/or levy (WDLs) against delinquent taxpayers. Implementation of these presupposes that the taxpayer failed...

THE PITFALLS OF UNTRUTHFUL RETURNS AND DECLARATIONS

By Mark Anthony Tamayo on August 26, 2021

It is the basic duty and responsibility of every taxpayer and importer to provide truthful tax returns and import declarations.

Taxpayers are responsible for accurately determining their taxable incomes, computing their tax liabilities and submitting...

TAKING TAX EVASION SERIOUSLY

By Nica Marsha Gasapo on August 19, 2021

The Bureau of Internal Revenue (BIR) recently issued Revenue Regulations (RR) 13-2021, which implement amendments to the National Internal Revenue Code of 1997’s (the “Tax Code”) penalty provisions as amended by Republic...

NEW ESTATE TAX AMNESTY AND QUARANTINE BIR REGULATIONS

By Euney Marie Mata-Perez on August 12, 2021

To the relief of many taxpayers, Republic Act (RA) 11569 was passed amending RA 11213 (Tax Amnesty Act) and extending the availment of the tax amnesty to June 14, 2023.

In accordance thereto, the Bureau of Internal Revenue (BIR) issued Revenue Regulations...